Our Tips and Tricks for the Best Homeowner Insurance Coverage in 2016

Must-Read Facts For Homeowner's Insurance Buyers

April 15, 2016

Must read facts for Florida homeowner insurance buyers. You've just bought a beautiful house, and you are very happy with it. You want to do everything in your power to protect this asset for you and your family. The first step is to purchase Florida homeowners insurance, but navigating that can be difficult. There are important measures to take into account so that you can get the best and most affordable coverage for your new home. What you can expect Coverage-Wise First, it is important to understand what you can expect coverage-wise. Be smart when shopping around, knowing what typical rates are and what the limits are. Reasonable insurance will cover your property and belongings in case of a natural disaster or theft. It protects you against anyone who may try to sue you for injuries sustained on your property. Sometimes, homeowner's insurance will extend to protect items inside your car that if stolen, auto insurance won't cover. Decent homeowner's insurance will also extend to your belongings during travel. When choosing a homeowner's insurance, research market value in addition to replacement coverage. Insurance with reasonable market value will ensure that in case of total destruction to your property, there is still...

7 Tips To Get The Most Out Of Home Insurance

April 19, 2016

7 Tips To Buying And Getting The Most Out Of Homeowner Insurance Contrary to what a lot of people think about home insurance being a necessary evil, there comes a time when you will be grateful to have one. Your home is regarded as your most valuable and biggest asset and that is what home insurance seeks to protect. After investing so much time, money and energy in getting a home and keeping a home, it is only logical that it should be protected from whatever factor that can cause it harm. Because we understand that many people know little or nothing about insurance especially home insurance, we bring you 7 tips you would need when buying home insurance, getting the best value for your money so that when the time comes to put it to use, you will be ready. Tip 1: Ensure that you know the precise value of your home and the amount of home insurance you need. It is very important to determine from the onset the amount of insurance you will need. To do this, engage the services of a home builder or an assessment company to give you the true value of your home. They will do this...

Easy Steps To Lower Your Homeowner's Insurance Rates

April 22, 2016

Easy Steps To Lower Your Homeowner's Insurance Rates You've just made an investment for yourself, your family, and your finances – you bought a house! You put in hard work to save up the money, and it has finally paid off. Now, it is time to invest in a strong, affordable homeowner's insurance policy to protect what you've worked so hard for. Sometimes it is hard to imagine affording a policy on top of purchasing a home, but it is most important to protect your home from unforeseen instances. These tips will help you find an insurance policy that is affordable for you. First, be smart in managing your deductibles. Research the area you live in and see if the insurance companies around you have one deductible or separate split deductibles for different kinds of damage. If you purchase a policy with only one deductible, do whatever you can to increase that deductible. Although you will be paying more right away, your insurance will pay out higher claims, saving you on your premiums. If you have multiple deductibles – say one for windstorm damage and one for hail damage, research which damages are more likely to occur in your area. Increase your deductibles...

Helpful Hints For Buying Homeowners Insurance

April 24, 2016

Helpful Hints For Buying Homeowners Insurance If you've never purchased a home before, the process can certainly be a bit overwhelming. With so many other pressing concerns that need to be dealt with, it is easy to forget all about homeowners' insurance. When you are in the process of selecting a policy, these helpful hints will guide your decision. Speak To Multiple Companies and Shop Around Your mortgage lender will typically require you to purchase homeowners' insurance, so be sure to contact at least three different companies who can provide the necessary coverage. Depending on the terms of your mortgage lending agreement, you may also have to purchase additional forms of coverage, such as flood insurance. When speaking to insurance companies, compile as much information as possible about coverage, prices and reviews. You'll want to seek the best value, as opposed to holding out for the lowest price. Excellent customer service is also a must. Learn More About Escrow In most instances, the homeowner should escrow their insurance payments with their mortgage payments. Most homeowners typically tack their monthly insurance payments on top of the mortgage check that they are responsible for writing each month. With an escrow account, you can rely on the...

Best Florida Home Insurance in 2016

April 28, 2016

Best Florida Home Insurance in 2016 Homeowners can obtain the best property insurance through considering multiple factors, which includes investing your time into research. We cover important areas to go over when looking for the best coverage in 2016. It does not need to be a difficult task to find the right insurance policy in Florida; we break down the differences between what makes an insurance company, local or national, a good one. It's beneficial to understand what customer surveys reveal about the potential insurance company you intend to purchase from. Another necessary step is simply obtaining free quotes online to identify an average rate; it's recommended to get at least four to five. We've developed a more in-depth guide on how to successfully conduct a homeowner insurance comparison for additional details. The best homeowner insurance in Florida is determined by price, claims, and coverage. These additional components should be considered along with customer satisfaction. Every insurance policy is different and it's vital to obtain the one that is going to be the perfect fit for your home. Some coverage options important to understand are the following: Personal Property: This coverage provides protection for your personal belongings such as your clothes, furniture, electronics, and...

How to Compare Homeowners Insurance in Florida

June 5, 2016

How to find Cheap Homeowners Insurance in Florida It's important to beware of websites providing bogus Florida homeowner insurance comparison charts, it's unfortunate. However, there are some websites claiming to provide a comparison of insurance rates in Florida however what they really are doing is misleading. It can become as bad to being lied to with some of these automated lists of the best insurance rates. We created this guide for anyone in the market to understand the best strategies to determine the best kind of policies for their property insurance quickly. Our knowledge is from over a decade of experience saving people thousands of dollars each year with our comparison method explained in this guide. The knowledge we are providing can save you hundreds if not thousands of dollars, prepare to have a more in-depth understanding comparing property insurance in Florida. Focus on the value of protection and not only on the price. It's really important for understanding the level of protection you're receiving and not overlook it with a low price. A lot of these comparison websites like to try and be attractive with displaying low prices for multiple types of coverage. However, it's the details of the protection from the...

Florida is the Most Expensive State in America for Property Insurance

June 5, 2016

Florida is the Most Expensive State in America for Property Insurance Florida is well known as one of the sunniest states in the country; it is also the home of the highest homeowner insurance rates. Those who are new to this state will be surprised at the substantial difference in prices of coverage for property. The number one reason behind the sky rocketed insurance rates is because of the state having so much coastal real estate. The risk for natural disasters from hurricanes and tropical storms is higher than in any other state. At this time during 2016, the typical homeowner policy in Florida is double the national average. The county your property resides in will help dramatically with cost. Leon County provides the lowest rates, for example, because of its center-of-state location. Properties located in the southern half of the state that are closer to the ocean have the highest average insurance policy rates. Counties include Monroe and Miami-Dade. The history of these counties is filled with a lot of natural disasters, dramatically increasing the total cost for coverage. It's very important to obtain home insurance in Florida that is going to provide you with adequate protection without being too much of...

5 Useful Tips For Minimizing Homeowners' Insurance Costs

June 5, 2016

5 Useful Tips For Minimizing Homeowners Insurance Costs While homeowners' insurance can be very expensive, there is no reason why a homeowner should not investigate every possible avenue for reducing the costs. Did you know that there a variety of simple ways to cut down on your insurance premiums each month or year? If not, be sure to read on, so that you can learn more about these five useful tips for cutting down on homeowners' insurance costs. 1. Paying Off Your Mortgage Some might be shaking their head and wondering why this is even being suggested, while others are already well on their way to achieving this goal. Paying off your mortgage may seem like a difficult concept, but by doing so, you guarantee yourself a lower homeowners' insurance premium. Why? For one simple reason: the insurance company is much more likely to trust a homeowner who owns their property outright to take better care of it. 2. Review Your Policy Annually A homeowner should start a yearly tradition of shopping around and comparing other homeowners insurance florida policies to their own. It is also important to perform a thorough review of your own policy, so that you can uncover any changes that...

Florida homeowners insurance quotes online

June 6, 2016

A Guide To Purchasing Homeowners Insurance Homeowners are required to purchase homeowners insurance so that they remain protected when disaster inevitably strikes. But getting started is all about establishing the proper contract, one that will protect from the harsh realities of your chosen region. If you are in the process of purchasing homeowners insurance and do not know where to start, this guide will serve as a helpful companion. Selecting The Best Insurer The first aspect that you should look into when considering a particular insurer is their level of customer service. This is best measured by their responsiveness when claims are filed. A highly rated insurer will provide their customers with the correct amount of money when a claim is filed, whereas a lower rated insurer will leave a trail of unsatisfied customers in its wake, by providing them with consistently low settlements. Finding a company that pays out settlements in a timely fashion is also crucial. Ability To Settle Claims When a person has paid their premiums on time and been a loyal customer, the last thing that they want is to haggle with an insurance provider that will not make an effort to see eye to eye with...

Florida home insurance quotes

June 6, 2016

Eight Tips To Give Homeowner's Peace Of Mind -Homeowners Insurance Knowing what your homeowners insurance covers before disaster strikes can save you and your family a great deal of stress. Do you know what your insurance policy covers, what it doesn't cover? There are eight things everyone can do to make sure they have peace of mind and full homeowner's protection before anything happens. 1. Get an accurate inventory of all your belongings. Should anything happen, it is important that you have a record to prove the things you own and that their worth is verified. It is always a lot easier to take a good inventory while you still have all your possessions. One of the easiest ways to do this is to get a video inventory on record. Go through your home with a video camera, going through each room making sure to get everything owned on record. Remember to also get the basement, attic, any closets as well as any storage units you may own located elsewhere. If you don't have a video camera or have no means to rent or borrow one, then make a list of all your items and take pictures of them. Make sure to keep...

Cheap automobile insurance companies in Florida

April 15, 2016

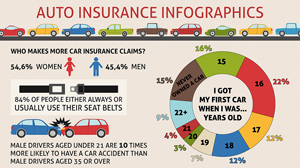

Cheap automobile insurance companies in Florida There's a common saying you get what you pay for, this holds true for many things, and the same can be said about car insurance. When it comes to purchasing coverage for your vehicle the amount of time invested in conducting research for a reliable policy is mandatory. Do not spend the same amount it takes to pick out a cartoon of milk at the store or else risk the consequences come time to filing a claim. It's unfortunate the horror stories that exist online with people sharing their experiences with insurance companies in Florida that try and not pay for their claims. However, fortunately, their decision on purchasing a cheap automobile insurance policy can educate you not to make the same mistake. Now not all cheap car insurances are bad, there is the bare minimum allowed that is offered from all reputable insurance companies. In the state of Florida, limited coverage is required, or you can have your license suspended and face fees. The first offense includes a $150 reinstatement fee and license and registration suspension for up to three years. However, if proof of insurance is provided within the accepted time, you can avoid...

Cheap Car insurance Tips in 2016

April 28, 2016

Cheap Car insurance Tips in 2016 Accidents are always an unpleasant experience that can financially burden those without the correct type of auto insurance. In this guide, we go over all of the basics required to understand in order to conduct a well knowledgeable choice of a car insurance policy. Having enough coverage is vital, the details of a policy are very important once you actually experienced an accident. We go over the differences between liability, comprehensive and or collision coverage. We also cover additional coverage along with some other tips that will provide you substantial savings and great protection. It's the law to have at lease liability car insurance, this coverage will pay for death related claims and personal injury done to a third party. Property damage is also covered in the event you damage a person's property. Collision coverage will pay for repairs for your vehicle after an accident. This coverage is required for those who have a loan on their car. Technically, until you pay off the loan on your vehicle it's the property of the bank, and they make it essential to have this protection to avoid a damaged vehicle. Car insurance comparison done online is the most effective...

Some facts About Why Car Insurance Rates Continue to Rise

June 5, 2016

Why it's difficult to obtain cheap Florida car insurance Did you know with the low cost recently of gas prices has increased driving, as a result of this, vehicle deaths have risen by a staggering 8 percent! Automobile insurance is predicted to rise in 2016 due to these statistics. It is estimated by the National Safety Council that 38,300 drivers died as a result of driving in America for the year 2015, 4.4 million people were critically injured. It's also being reported that the year 2015 was, unfortunately, the deadliest year for drivers since 2008. A Theory of the increase in deaths is because of drivers distracted by text and mobile phone calls, it's being reported that last year a quarter of all crashes was because of cell phones. According to the NSC Florida experience an increase of 18 percent for fatality rates. As more accidents are increased than the same will happen with insurance policy rates. One additional factor of the increase in deadly accidents is because of the increase of inexperienced drivers such as teens becoming first time drivers, this is why the younger you are the higher its going to cost you for your car insurance policy. Unfortunately, right...

Four Car Insurance Questions to Ask before you Purchase a Car

June 7, 2016

Four Car Insurance Questions to Ask before you Purchase a Car It sure is exciting when buying a new vehicle for yourself or a family member. Most people are exhausted by the time the sale is over and are only concerned with speeding through obtaining coverage for their newly purchased car. However, it's important to take some time to evaluate different quotes for your financial investment. You do not need to conduct multiple phone calls or visits to insurance agents for quotes, the most convenient way to compare car insurance is online. Let's begin with our four top questions to inquire about. What alternative vehicles, that are similar, will have a cheaper car insurance in Florida policy rate? It's important to consider the cost of a vehicle's insurance before conducting the purchase, perhaps there is a model that is similar to a reduced cost to insure. The difference of a car being classified as a sports vehicle and a regular sedan can be dramatically different in the cost of the monthly premium. Why is gap insurance important if I am financing a new car? If you're a teen driver with a brand new vehicle this additional coverage is almost essential for protecting your new automobile...

How to find the best auto insurance in Florida

June 7, 2016

How to find the best auto insurance in Florida Those who are in the market for auto insurance can significantly benefit with our guide as a reference before deciding on coverage. This type of purchase requires more than a few minutes of research and deserves as much as a couple of hours if not days. Whether you're a new driver or switching, it's important to compare the rates available with free quotes. We recommend contacting top auto insurance companies based on customer surveys and reviews online from reputable resources. Do not settle for automated results from websites that will only display companies that are paying them to do so, explore well-known insurance companies on your own manually for the best information about coverage and rates. Consider the type of coverage needed before committing to a policy, a much newer vehicle should have full coverage to avoid being stuck with no automobile. However, if you cannot afford full coverage, there is cheap car insurance Florida available with the bare minimum coverage to allow you to drive legally. PLPD (Public Liability and Property Damage) can cost as low as twenty dollars and is popular among those who can't afford to pay for full coverage. Law...

Obtain the best auto insurance rates in Florida

June 7, 2016

Obtain the best auto insurance rates in Florida Its quite common for the dealership to offer a car insurance of their recommendation, however, did you know it might not be the best one suited for your needs? Those interested in paying less for more can do so simply by opting in their information with us, we will display multiple rates best for you based on the information provided. Allow us to make it easy to compare auto insurance Florida, quickly discover the difference in cost for the same coverage among many top-tier insurance companies. Every driver is different and the same is true of each vehicle on the road as well, a younger driver, for instance, is not going to be able to acquire such a great deal as an older experienced driver with no traffic violations. Those who are in the position of purchasing a brand new car will find themselves requiring full coverage; this is to protect the interest of the bank giving you the loan. Even if you were to pay off a brand new car from the lot it's recommended to protect your investment in case the unfortunate was to occur. Thanks to the Internet it's not possible...

Cheap Commercial Property Insurance

April 19, 2016

A Primer On Commercial Property Insurance Commercial property insurance is typically all that stands between a business owner and a major financial loss. Whether you own the building your company is using, lease it or work out of your residence, property insurance keeps your investment safe. A commercial property insurance often varies, depending on the event that you seek protection from and the specific insurance chosen. The following questions are the most frequently asked when it comes to commercial property insurance, so let's take a closer look at these common queries. What Does Business Property Insurance Cover? When you purchase commercial property insurance for your business, your building is protected, as well as your inventory, your outdoor signage, your landscaping, fencing, furniture, work-related equipment and anyone else's property on the premises. What Should I Know About Business Property Insurance? Not only is a smart investment for any business owner out there to make, but it also keeps the business protected if there are any natural disasters or unforeseen events that lead to a prolonged period of closure. The physical assets of the company are protected, as well as its ability to remain viable in the face of windstorms or hurricanes. What Are The Policy Basics? While these...

Top 6 Insurances Essential for your Business

April 28, 2016

Top 6 Insurances Essential for your Business So you're a resident in the state of Florida and your starting out with a new business, you're going to want to protect your new business with a variety of coverage. The first type of insurance important to any business is property insurance. A business needs this to protect their assets and business property. It's important to find a policy that is going to cover all of your business equipment, merchandise, or anything else essential in the event of a natural or accidental disaster. A required insurance for any business in the state of Florida is general liability. This covers any damage conducted to your business by any third party, this also covers any bodily injury at the fault of your services, employees or products. Additional required business insurance in Florida is Workers compensation. You need this to protect your employees when they experience an injury at your business. Workers are given medical benefits along with partial wage replacement that experiences injury on the job. The employee automatically forfeits the ability to sue when they accept the benefits. Commercial auto insurance is only required if your business conducts deliveries, transportation, or any other type of business that...

A Concise Buyer's Guide To Business Insurance

June 7, 2016

A Concise Buyer's Guide To Business Insurance The process of selecting business insurance is fraught with peril and no one likes the prospect of letting money go to waste. To learn more about each aspect of your potential coverage package, keep reading. 1. Knowing What You Need All businesses need to start with a basic worker's compensation policy and this is typically non-negotiable, as the costs of going without one are simply too steep. Property insurance is also an essential must, as this protects your equipment and your inventory. General liability coverage is necessary since it keeps a business from having their coffers completely wiped out by a garden variety injury claim. A business owner policy may also work best for your needs as these policies allow you to combine your property and liability coverage, lowering the overall premium. 2. Growing Companies If a business is growing and using more vehicles, business vehicle insurance is recommended, especially for those who use a company car for work purposes. A personal auto insurance policy will not provide full coverage if an accident is sustained while business related tasks are being carried out. Employment practice liability insurance keeps a business insulated from frivolous lawsuits that are related to the...